What Is the Nasdaq?

The Balance / Lara Antal

The Nasdaq is the second-largest stock and securities exchange in the world, behind only the New York Stock Exchange (NYSE). All of its trades take place electronically through dealers, rather than in a physical location directly between traders. In general, Nasdaq attracts more tech- and growth-oriented businesses than other exchanges.

Key Takeaways

- The Nasdaq is the second-largest stock exchange in the world.

- It became the first electronic stock exchange in 1971.

- Companies listed on the Nasdaq tend to be high-tech and growth-oriented.

- Nasdaq equities are generally seen as more volatile than those traded on the NYSE, but they can boast very high returns.

Definition and Example of the Nasdaq

Unlike some other exchanges, the Nasdaq has no physical trading floor. All of its stocks are traded electronically through an automated network of computers. This was its mission from the beginning.

Note

Nasdaq was the world's first fully electronic stock market in 1971.

The Nasdaq attracts some of the largest blue-chip companies in the world. Many of its listings represent high-tech software, computer, and internet companies, although other industries also trade on the Nasdaq. Major stocks that trade on the Nasdaq include Apple, Amazon, Microsoft, Meta (formerly Facebook), Gilead Sciences, Starbucks, Tesla, and Intel. Because it attracts highly growth-oriented companies, its stocks tend to be more volatile than those on some other exchanges.

As the world's second-largest stock exchange based on market capitalization, the Nasdaq trades listed stocks as well as over-the-counter (OTC) stocks. Stock ticker symbols on the Nasdaq generally have four or five letters.

A history of the Nasdaq shows a track record of groundbreaking accomplishments. In addition to being the first exchange to offer electronic trading, it was the first to launch a website, store records in the cloud, and sell its technology to other exchanges.

In 2008, Nasdaq merged with OMX ABO, a Stockholm-based operator of Nordic and Baltic regional exchanges. The new company, Nasdaq, Inc., also offers trading in exchange-traded funds, debt, structured products, derivatives, and commodities.

- Alternate Definition: The Nasdaq Composite, a market index fund (like the Dow or the S&P 500) designed to follow the general trends of the Nasdaq.

- Acronym: Originally styled as NASDAQ, the name is an acronym for the National Association of Securities Dealers Automated Quotations.

Note

The Nasdaq lists nearly 4,178 companies and boasts a high trading volume. The total value of listings on the Nasdaq totaled $28.2 trillion in 2021.

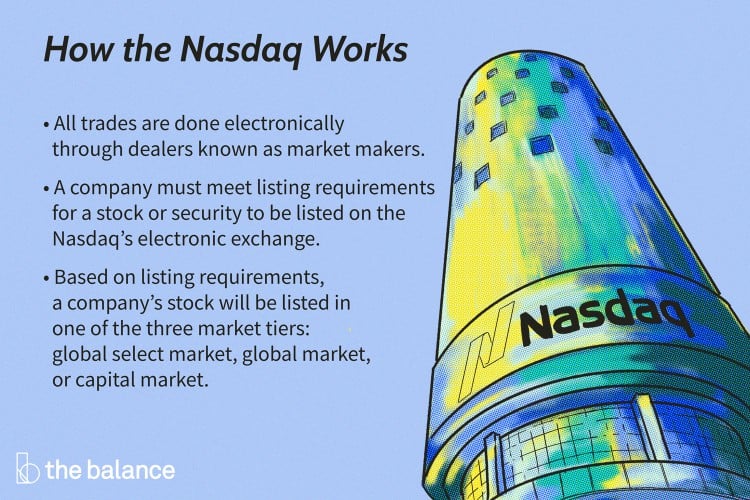

How the Nasdaq Works

From the beginning, the Nasdaq was designed to provide automated quotations. In the years following its founding, it regularly facilitated over-the-counter (OTC) trading, so much so that Nasdaq became synonymous with OTC and was often referred to as an OTC market by media and trade publications. Later, it added automated trading systems that could create trade and volume reports. It also became the first exchange to offer online trading.

As a dealer's market, all trades that investors make over Nasdaq's electronic exchanges are completed through dealers—also known as "market makers"—rather than directly via auctions.

Nasdaq Trading Hours

Just like the NYSE, the Nasdaq is open for trading between 9:30 a.m. and 4 p.m. ET. Nasdaq offers traders "pre-market" and "post-market" hours. Pre-market hours are from 4 a.m. to 9:30 a.m. ET, and post-market hours are from 4 p.m. to 8 p.m. ET.

Nasdaq Listing Requirements

For stocks or securities to be listed on the Nasdaq electronic exchange, a company must:

- Meet certain requirements based on its finances, liquidity, and corporate governance

- Be registered with the Securities Exchange Commission (SEC)

- Have at least three market makers

- Meet other requirements based on company size and trading volume

Once an application is submitted, it may take anywhere between four and six weeks for the company's listing to be approved.

Nasdaq U.S. Market Tiers

Based on the listing requirements, a company's stock will be listed in one of three market tiers:

- Global Select Market: This composite is made up of the stocks of U.S. and international companies and is weighted based on market capitalization. Companies listed here must pass Nasdaq's highest standards. Global Market listings are surveyed annually by Nasdaq's Listing Qualifications Department, which will move them to the Global Select Market if eligible.

- Global Market: Nasdaq's Global Market consists of stocks of companies listed in the United States and internationally. It is considered to be a mid-cap market.

- Capital Market: Once called the SmallCap Market before Nasdaq changed the name, the Capital Market is a large list of companies with smaller market capitalizations.

Nasdaq vs. NYSE

Together, the New York Stock Exchange and the Nasdaq represent a major portion of U.S. stock trading, but the two markets do have some distinctions.

| Nasdaq | NYSE |

|---|---|

| Fully electronic trading system | Trade electronically and on physical trade floor |

| Dealer's market, not direct | Auction market facilitating direct trades |

| Narrower, smaller market (tech-heavy) | Broader, larger market |

| More volatile, growth-focused | Less volatile |

Nasdaq Performance

Because the Nasdaq is largely made up of tech stocks, its overall performance has been very strong in the last quarter-century. As of November 3, 2021, the NASDAQ-100 index, which includes the top 100 stocks in the exchange, reported a five-year return of 196.31% and a 10-year return of 552.24%. Meanwhile, its Composite Index reported a 171.64% five-year return and a 10-year return of 444.12%.